Second Quarter of 2025

“Far more money has been lost by investors preparing for corrections or trying to anticipate corrections than has been lost in corrections...

6 min read

Jonathan Reichek, CFA

:

Sep 30, 2023 5:27:00 PM

Jonathan Reichek, CFA

:

Sep 30, 2023 5:27:00 PM

Our annual client meeting will take place on the evening of February 22, 2024, at the Briar Club in Houston. Our keynote speaker will be Dr. Peter Stone, founder, and director of the Learning Agents Research Group (LARG) within the Artificial Intelligence Laboratory in the Department of Computer Science at The University of Texas. Dr. Stone is also the Chairman of the Artificial Intelligence Division of the SONY Corporation. We hope to see you there. Stay tuned for more details early next year.

Geopolitics

I vividly remember November 9th, 1989. It was the day the Berlin Wall came down. It led to freedom and capitalism across Europe, improved relations with Russia, and a more stable world. In 2001 China joined the World Trade Organization. This enabled China to truly be a part of the global economy and led to increased trade between the West and China. As you know Russia invaded Ukraine last year. Experts thought Russia would take over Ukraine in a matter of weeks, but the experts have once again been proven wrong and the war continues. Our relationship with China has massively deteriorated in recent years over differences in philosophy around intellectual property, Taiwan, trade, the spy balloon incident and more. The War in the Middle East is the most recent event to destabilize the world. All of these events have combined to increase uncertainty and uncertainty is a negative for markets.

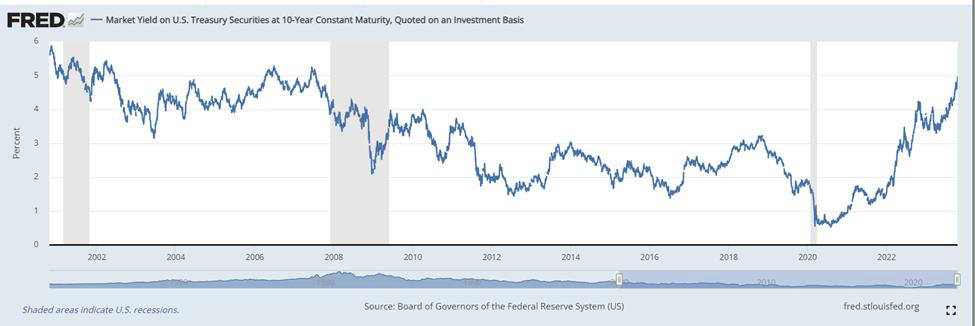

Bond Yields

Valuation multiples of stocks and long-term borrowing rates in the US are based on the yield of the 10-Year Treasury Bond. The 10-Year Treasury Bond now yields almost 5% up from 4.2% at the beginning of September and is at levels not seen since 2007.

Several factors have led to the increase in yields.

The bottom line is that there is more supply than demand for 10 Year Treasuries. 5% is the yield where supply meets demand. As a result, mortgage rates are 7% to 8%, Investment Grade Corporations now have to borrow money at 5.5% to 6%+, and multiples on stocks have come under pressure.

Today it is difficult to find high quality stocks that have yields above the 10-year Treasury. In fact, there are only a handful of stocks in the S&P 500 that have yields above the 10-year Treasury. It wasn’t that long ago that the S&P 500 index had a yield above the 10-year. Bonds have been a mediocre investment for a long time. They are again a viable investment option; especially for those who are retired. We have a Municipal Bond Strategy that yields upwards of 4%, an Investment Grade Corporate Bond Strategy that yields upwards of 5%, a Cash Management strategy that is risk free and yields over 5%, and a Preferred Stock Strategy, which is riskier than bonds, which yields 7%.

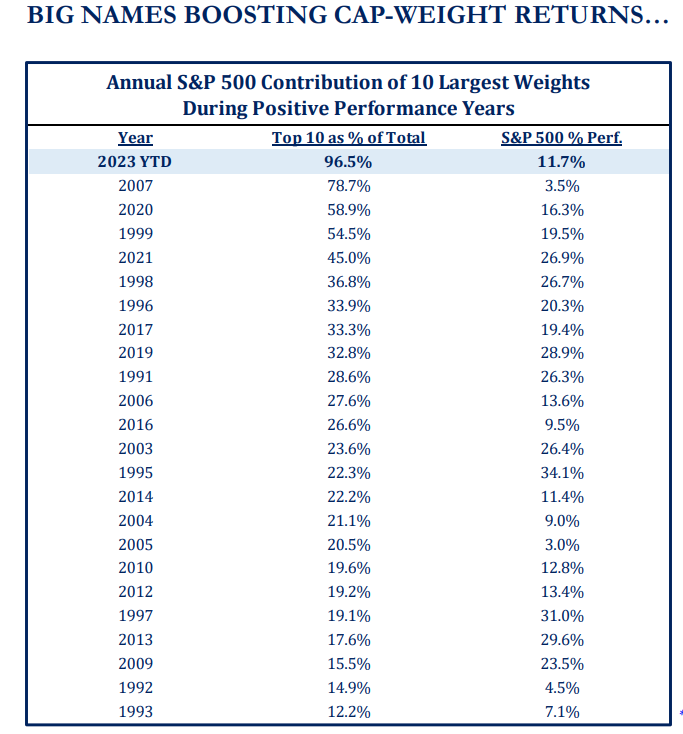

Overall, we were mostly satisfied with our performance through July, but August, September, and October have all been negative. The Russell 2000 (small cap stocks) and the Russell 3000 Dividend Growth index (Dividend Stocks) are down for the year and the Dow Jones Industrial Average is barely positive. Bond indices are negative for the year and now down for 3 years in a row.

The chart below from Strategas shows that virtually all the gains this year in the S&P 500 are from the 10 largest stocks. Excluding the 10 largest stocks the average stock is about down for the year.

Utilities and REITs which we own in our Dividend Strategies are having a mediocre year due to the rise in interest rates. Our exposure to Utilities and REITs is significantly less than what it used to be. However, both sectors consist of desirable companies that increase their dividends every year. We will continue to be invested in REITs and Utilities and expect them to bounce back in the future.

Performance

Here is our cumulative performance through Q3 net of fees. As accounts are customized your performance may be slightly different than what is shown below:

|

Strategy |

YTD * |

1-Year |

3-Year |

5-Year |

10-Year |

|

Friedberg Focused Equity |

+9.29% |

+11.45% |

+13.67% |

+35.90% |

+101.96% |

|

Brasada US Equity |

+2.62% |

+7.77% |

+27.97% |

+50.73% |

+152.68% |

|

Friedberg Dividend Growth |

-1.74% |

+1.47% |

+7.92% |

+29.67% |

+78.28% |

|

Brasada Municipal Bond |

-3.07% |

+0.72% |

-9.96% |

-2.54% |

+3.56% |

|

Friedberg Equity Income |

-12.20% |

-8.62% |

+4.63% |

+15.01% |

+56.90% |

|

Brasada Preferred Income |

+1.13% |

+0.90% |

-15.47% |

- |

+5.53% ** (Since Inception) |

* YTD returns are estimates and have not yet been audited by a third party ** Brasada Preferred Income’s inception date is 1/1/2019

Outlook

The economic picture is mixed. We anticipate a slowdown in consumer activity as excess savings accumulated during Covid have mostly been depleted and as the student loan forbearance program has ended. Higher yields will slow the economy, the size of US Government debt is becoming a real problem, and we are in a very uncertain world. On the other hand, spending on infrastructure is just getting started and should provide a meaningful boost to the economy over the coming years. The market is oversold, the Fed is at the end of the rate hiking cycle, and investors are Bearish. We don’t know what will happen to the markets over the coming months, but we are Bullish over the long term. The companies we are invested in have great business models with management teams that are competitive and have a desire to win. We will continue to focus on following the companies we own and searching for new ones. We think it’s critical in this business to eat your own cooking. As a reminder we are invested alongside you in the same strategies.

Schwab

All TD Ameritrade Accounts migrated to Schwab in September. If you need help logging into your new Schwab account or have another issue with Schwab, please let us know. The transition has gone somewhat smoothly. We are still working out some minor issues. For example, we are aware that many of you are receiving notices from Schwab on Corporate Actions. We handle these for most clients and for those where we are not set up to handle them, we will be reaching out to you to resolve this.

All the Best,

Jonathan Reichek

This quarterly update is being furnished by Brasada Capital Management, LP (“Brasada”) on a confidential basis and is intended solely for the use of the person to whom it is provided. It may not be modified, reproduced or redistributed in whole or in part without the prior written consent of Brasada. This document does not constitute an offer, solicitation or recommendation to sell or an offer to buy any securities, investment products or investment advisory services or to participate in any trading strategy.

The net performance results are stated net of all management fees and expenses and are estimated and unaudited. These returns reflect the reinvestment of any dividends and interest and include returns on any uninvested cash. In addition to management fees, the managed accounts will also bear its share of expenses and fees charged by underlying investments. The fees deducted herein represent the highest fee incurred by any managed account during the relevant period. Past performance is no guarantee of future results. Certain market and economic events having a positive impact on performance may not repeat themselves. The actual performance results experienced by an investor may vary significantly from the results shown or contemplated for a number of reasons, including, without limitation, changes in economic and market conditions.

References to indices or benchmarks are for informational and general comparative purposes only. There are significant differences between such indices and the investment program of the managed accounts. The managed accounts do not necessarily invest in all or any significant portion of the securities, industries or strategies represented by such indices and performance calculation may not be entirely comparable. Indices are unmanaged and have no fees or expenses. An investment cannot be made directly in an index and such index may reinvest dividends and income. References to indices do not suggest that the managed accounts will, or is likely to achieve returns, volatility or other results similar to such indices. Accordingly, comparing results shown to those of an index or

benchmark are subject to inherent limitations and may be of limited use.

Certain information contained herein constitutes forward looking statements and projections that are based on the current beliefs and assumptions of Brasada and on information currently available that Brasada believes to be reasonable. However, such statements necessarily involve risks, uncertainties and assumptions, and prospective investors may not put undue reliance on any of these statements. Due to various risks and uncertainties, actual events or results or the actual performance of any entity or transaction may differ materially from those reflected or contemplated in such forward-looking statements. The information contained herein is believed to be reliable but no representation, warranty or undertaking, expressed or implied, is given to the accuracy or completeness of such information by Brasada.

“Far more money has been lost by investors preparing for corrections or trying to anticipate corrections than has been lost in corrections...

.png)

UNDERSTANDING TARIFFS: ECONOMIC IMPACT, RATIONALE AND CONTROVERSIES

%20(3).png)

Market Selloff Dear Clients and Friends, Thursday and Friday marked the 4th time in the last 50 years when the S&P 500 had a 2-day drop of over...