Second Quarter of 2025

“Far more money has been lost by investors preparing for corrections or trying to anticipate corrections than has been lost in corrections...

Market Review

As we cross the midpoint of 2023, the economy has proven itself to be much more resilient than expected. Despite the run-up in interest rates over the course of the last year and a half, consumer spending has remained strong, with shoppers eagerly spending and hitting stores and travel destinations with what seems to be a carefree spirit. The labor market is still hot although showing signs of softening. The unemployment rate is at a 50+ year low and is not cooperating with the Fed’s desire to slow the economy.

In June, the markets saw some relief as the Fed did not raise rates for the first time during this cycle. However, based on recent economic data the market expects the Fed to raise rates again by 25 basis points at the next meeting at the end of July. Inflation continues to show signs of receding with the Consumer Price Index (CPI) falling by more than half since June of 2022. The Fed shows no inclination toward rate cuts anytime soon despite the market signals earlier this year. The Fed was too slow to raise rates in 2021, and they don’t want to make the mistake of cutting rates too soon.

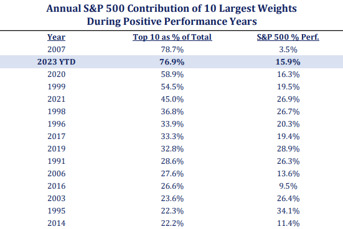

Meanwhile most gains in the equity markets this year have been driven by large technology stocks. The S&P 500 is up over 15% year-to-date, but 77% of that return is from the top 10 stocks in the index (see exhibit 1). We believe much of this rise in big tech stocks has been driven by a combination of exuberance over AI, partial recovery from oversold positions, and liquidity injected into the market as a result of the banking crisis in the first quarter. The five largest stocks in the S&P 500 now comprise 24% of the index (exhibit 2), which is a record and makes the index less diversified. The other 490 stocks in the index are up low single digits, and the Dow Jones Industrial Average is up by just over 3%. Growth and technology stocks have staged a strong rebound this year, while more conservative dividend stocks have been laggards.

Exhibit 1 & 2. Source: Strategas

Exhibit 1 & 2. Source: Strategas

We believe this current set-up is unsustainable in the long run for big tech and presents attractive bargains within the rest of the market. We have been adjusting accordingly to capitalize on these inefficiencies.

Portfolio Changes

We have made several changes to our strategies during the quarter. In general, we have reduced our exposure to energy stocks and companies with higher debt loads. We have reinvested the proceeds in companies that have secular growth. Many of these were oversold in 2022, and we believe they were attractive at the prices we purchased them. Please note that as your accounts may be customized, we may not have purchased all or any of these stocks for your account.

New Positions

|

Strategy |

New Position |

Commentary |

|

Friedberg Focused Equity |

Paycom Software (PAYC) |

Paycom (PAYC) a provider of Human Capital Management and payroll software primarily for companies with fewer than 10,000 employees, is expanding its market by selling internationally, posing strong competition to ADP and Paychex with its superior offerings. The company's stock valuation is demanding but at an all-time low. The stock is well off its COVID-highs and we expect strong double-digit growth moving forward. |

|

Cellebrite Ltd (CLBT) |

Cellebrite (CLBT) offers law enforcement agencies a potent hardware/software combination to unlock and analyze data from mobile phones, a crucial asset as digital elements become ubiquitous in crime investigations. Boasting a customer base that includes over 100 US federal agencies and the 20 largest US police departments, Cellebrite is the 800-lb gorilla in its industry and is significantly undervalued at 3x revenues. |

|

|

Icon Plc (ICLR) |

Icon plc (ICLR) is a premier Contract Research Organization that has solidified its standing in the CRO market through its acquisition of PRA in June 2022. This bolstered its scale, therapeutic range, and global presence – attributes highly sought after by large pharma and biotech companies. As the CRO sector is primed for revival after a Covid hangover ICLR is projected to grow revenues 7 to 9% per year through 2025.

|

|

|

Friedberg Dividend Growth |

Boston Scientific Corp (BSX) |

Boston Scientific (BSX) is a leader in medical technology with a focus on cardiology, endoscopy, urology, and neuromodulation. BSX garners substantial revenue from critical care, generates high free cash flow conducive for mergers and acquisitions, and is poised for growth due to an increase in patient volumes and new products for atrial fibrillation. |

|

Broadridge Financial (BR) |

Broadridge (BR) is the leading provider in investor communications, securities trade processing, and data analytics, with a near monopoly in proxy distribution and excelling in streamlining administrative processes for financial institutions and corporate issuers. The business has emerged from a major multi-year investment in financial services software. Through its expertise in managing cost-centric activities and a rapidly expanding wealth management process management business, Broadridge is poised for high single-digit growth and rapid free cash flow generation as it continues to consolidate and dominate this specialized market niche. |

|

|

Constellation Software (CNSWF) |

Constellation Software (CNSWF) is a powerhouse in the vertical market software space, leveraging a strategic approach to mergers and acquisitions to acquire companies with strong customer bases and pricing power at bargain prices. Its top-tier management team drives single-digit organic growth, margin expansion, and reinvests free cash flow efficiently, positioning the company for sustained high double-digit returns. |

|

|

Brasada US Equity |

Eaton Corp Plc (ETN) |

Eaton Corporation (ETN) is strategically positioned to harness the global shift towards electrification and the “everything as a grid” concept. With its rich expertise, IP, and strong partnerships, Eaton is deeply involved in energy transition projects, including EV charging, microgrids, and zero-energy buildings, expecting to generate billions in energy transition related revenue by 2030, positioning it as a critical player in the sustainable energy market. |

|

ServiceNow (NOW) |

ServiceNow (NOW) is a trailblazer in streamlining enterprise workflows through its Now Platform, specializing in digitizing IT, employee, customer, and creator workflows. With a commanding position in IT service management, stellar customer retention, strong free cash flow, and an aggressive approach to innovation and acquisitions, ServiceNow is an attractive business and a prime beneficiary from AI innovation. We like the set-up due to its expansive product portfolio, consistent growth, and currently undervalued position. |

|

|

Builders FirstSource (BLDR) |

Builders FirstSource (BLDR) is a leading supplier and manufacturer of building materials and construction services in the US, operating through approximately 565 locations across 42 states. By providing an all-encompassing solution that combines factory-built components with professional installation, BLDR is ideally positioned to capitalize on the burgeoning US housing market through its extensive scale, manufacturing prowess, and strategic partnerships with major national homebuilders. |

|

|

Friedberg Equity Income |

Diageo (DEO) |

Diageo (DEO) is the premier global spirits company, boasting an impressive portfolio of brands such as Don Julio, Casamigos, Johnnie Walker, Tanqueray, Ketel One, and Crown Royal. With towering barriers to entry anchored by distribution and branding, we believe DEO is poised for sustained high single-digit earnings growth, as spirits gain market share over beer and wine, and the company continues to innovate and acquire brands. Currently valued at 20x price-to-earnings, which is on the lower end of its historical range, and with the stock down about 20% from its peak, we like our odds of success at our entry price point. |

|

Genuine Parts Co (GPC) |

Genuine Parts Co (GPC) is an established global distributor of automotive and industrial replacement parts, with a strong international footprint especially in Australia and Europe, and is known for its legacy NAPA brand in the US. The company boasts an impressive history of raising dividends and, despite a recent sell-off due to industry-wide concerns stemming from a poor quarter by peer, Advanced Auto Parts, GPC's underlying fundamentals and outlook remain robust. We believe the sell-off was an overreaction and that GPC is well-positioned for growth, as the issues faced by AAP were likely due to internal management issues rather than industry trends. |

|

|

Blackrock (BLK) |

Blackrock (BLK) has a 3% dividend yield, reduces share count through buybacks, trades at 18.5x Price-to-Earnings (NTM), and has no net debt. Blackrock is the dominant global asset manager run by Larry Fink and company. They own iShares, which we use for the ETF accounts, and they continue to have net inflows across most product lines. Asset managers have taken quite a hit throughout the past year but as the industry inevitably climbs back up, we like Blackrock's potential in leading the continued growth of passive ETFs, further consolidating the industry, and producing attractive returns. |

Exited Positions

|

Strategy |

Removed |

Commentary |

|

Friedberg Focused Equity |

Azenta Inc (AZTA) |

Not all ideas work out but we try to steer toward those with situations highly favorable for long-term wins. That's exactly what we saw in Azenta (AZTA) which had an enormous war chest of cash undergoing a major transformation into a pure play life sciences company. Unfortunately, management did a poor job of reinvesting some of the cash and they badly missed their public financial targets. |

|

Diamondback Energy (FANG) |

Across our strategies, we have been reducing exposure to energy. We are finding better opportunities elsewhere. We sold our position after the stock rallied on the news of an OPEC cut. |

|

|

Friedberg Dividend Growth |

CenterPoint Energy (CNP) |

We like Centerpoint, but sold the stock to reinvest in other names that we think offer a better long-term total return. |

|

Charles Schwab (SCHW) |

The company is more reliant on interest rates than it used to be. We were disappointed in the way Schwab has managed it’s investments over the last 3 years. We sold the stock and redeployed the funds into ideas that we like better. |

|

|

EOG Resources (EOG) |

Across our strategies, we have been reducing exposure to energy. We are finding better opportunities elsewhere. We sold our position after the stock rallied on the news of an OPEC cut. |

|

|

Brasada US Equity |

Barrick Gold Corp (GOLD) |

Our thesis on Barrick Gold (GOLD) at a high-level was a hedge against inflation but with the continuous downward trend of the CPI, higher rates, and signals of a likely mild recession, we decided to deploy capital into better opportunities. |

|

Cheniere Energy Inc (LNG) |

See Diamondback Energy commentary. |

|

|

Diamondback Energy (FANG) |

Across our strategies, we have been reducing exposure to energy. We are finding better opportunities elsewhere. We sold our position after the stock rallied on the news of an OPEC cut. |

|

|

Friedberg Equity Income |

Community Healthcare Trust (CHCT) |

We have also been reducing our REIT exposure as these businesses require continuous borrowing to fund growth via acquisitions. Higher rates mean lower returns on capital, which is a problem for Community Healthcare Trust. Additionally, their founder and highly respected CEO sadly and suddenly passed away in earlier this year. |

Market Outlook

After taking a beating over the past two years, the consumer’s spending power has gradually improved with the CPI more than halved. Meanwhile, the cost of borrowing has skyrocketed and remains elevated, but the jobs market remains strong and the US economy continued to grow at 2% in Q1 and is estimated to grow 2% for Q2.

The major question lingering is whether the Fed in their path to squash inflation will put us into a recession. Traditional key indicators like the yield curve, changes in liquidity and popular sentiment indices all point to a high likelihood of a recession, yet it does not feel like a recession is coming. Nonetheless, this still gives us cause to remain cautious, leading us to hold about 10% of our equity portfolios in short-term treasury bills yielding 5%.

While we cannot always successfully predict the direction of the markets or interest rates, what we can do is carefully select businesses that will do well in the long run despite potential unfavorable circumstances. We will continue to focus on following the companies we own and searching for new ones.

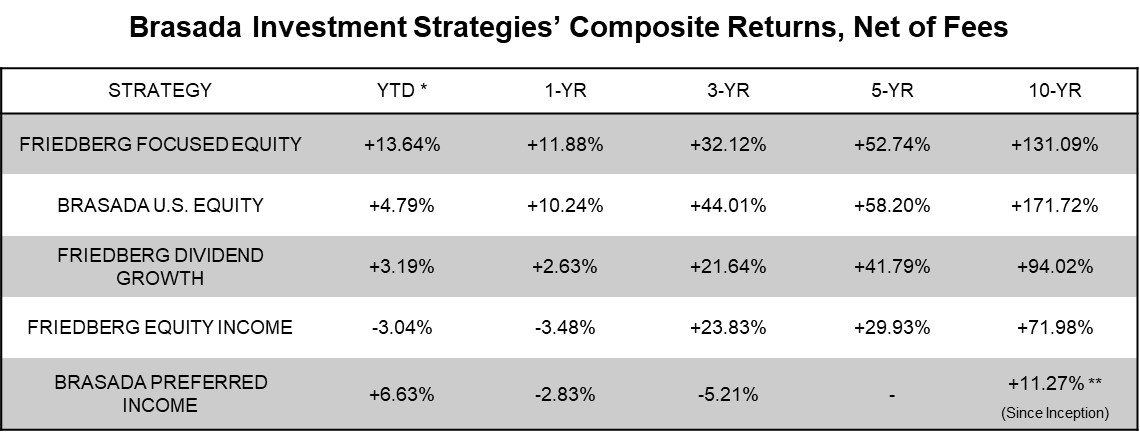

As you know, the portfolios we build for you are customized, so your experience will typically be different than the composite averages. Our private account strategies’ estimated net performance through June 30th as follows:

* YTD returns are estimates and have not yet been audited by a third party ** Brasada Preferred Income’s inception date is 1/1/2019

* YTD returns are estimates and have not yet been audited by a third party ** Brasada Preferred Income’s inception date is 1/1/2019

We think it’s critical in this business to eat your own cooking. As a reminder we are invested alongside you in the same strategies. We appreciate the confidence you have placed in us and wish you the best.

Sincerely,

Ed Zhang

This quarterly update is being furnished by Brasada Capital Management, LP (“Brasada”) on a confidential basis and is intended solely for the use of the person to whom it is provided. It may not be modified, reproduced or redistributed in whole or in part without the prior written consent of Brasada. This document does not constitute an offer, solicitation or recommendation to sell or an offer to buy any securities, investment products or investment advisory services or to participate in any trading strategy.

The net performance results are stated net of all management fees and expenses and are estimated and unaudited. These returns reflect the reinvestment of any dividends and interest and include returns on any uninvested cash. In addition to management fees, the managed accounts will also bear its share of expenses and fees charged by underlying investments. The fees deducted herein represent the highest fee incurred by any managed account during the relevant period. Past performance is no guarantee of future results. Certain market and economic events having a positive impact on performance may not repeat themselves. The actual performance results experienced by an investor may vary significantly from the results shown or contemplated for a number of reasons, including, without limitation, changes in economic and market conditions.

References to indices or benchmarks are for informational and general comparative purposes only. There are significant differences between such indices and the investment program of the managed accounts. The managed accounts do not necessarily invest in all or any significant portion of the securities, industries or strategies represented by such indices and performance calculation may not be entirely comparable. Indices are unmanaged and have no fees or expenses. An investment cannot be made directly in an index and such index may reinvest dividends and income. References to indices do not suggest that the managed accounts will, or is likely to achieve returns, volatility or other results similar to such indices. Accordingly, comparing results shown to those of an index or

benchmark are subject to inherent limitations and may be of limited use.

Certain information contained herein constitutes forward looking statements and projections that are based on the current beliefs and assumptions of Brasada and on information currently available that Brasada believes to be reasonable. However, such statements necessarily involve risks, uncertainties and assumptions, and prospective investors may not put undue reliance on any of these statements. Due to various risks and uncertainties, actual events or results or the actual performance of any entity or transaction may differ materially from those reflected or contemplated in such forward-looking statements. The information contained herein is believed to be reliable but no representation, warranty or undertaking, expressed or implied, is given to the accuracy or completeness of such information by Brasada.

“Far more money has been lost by investors preparing for corrections or trying to anticipate corrections than has been lost in corrections...

.png)

UNDERSTANDING TARIFFS: ECONOMIC IMPACT, RATIONALE AND CONTROVERSIES

%20(3).png)

Market Selloff Dear Clients and Friends, Thursday and Friday marked the 4th time in the last 50 years when the S&P 500 had a 2-day drop of over...