Second Quarter of 2025

“Far more money has been lost by investors preparing for corrections or trying to anticipate corrections than has been lost in corrections...

Our annual clients and friends’ dinner will be held at the Briar Club in Houston on March 30, 2023. Our in-person speaker will be Dan Clifton of Strategas Research Partners. Dan is an expert on politics and its impact on the financial markets. He was the speaker at our dinner four years ago, and we are excited to have him back. You should receive a formal invitation in mid-February. We hope you can make the event, and we will be live streaming it for those who cannot attend.

2022 was the worst year for the stock market since 2008, and the worst year for the bond market since the 1930s. Going into the year the Federal Funds Rate was 0%, and the Federal Reserve thought that inflation was transitory. During the year the Fed realized their transitory thesis was wrong, and they hiked rates at a historic pace to get to 4.25% (see chart below). Further, the war in Ukraine, which started in late February, made the Fed’s job to get inflation under control more difficult with increasing fuel and food prices. The conflict also introduced even more economic uncertainty with the first European land conflict since the 1930’s. Stocks and bonds have been repriced for these higher rates and greater economic uncertainty. While we are likely near the end of the rate hikes, their impact on the economy will take time to become evident.

Given the lag in the economic impact of rising rates, one of the key debates for 2023 is whether we will have a mild recession or a more pronounced one. If we have a mild recession, the stock market is likely priced for that based on current valuations. If we have a broader recession, then there is still downside to stocks from here. Either way, we expect the Fed to finish raising interest rates this year, and history would indicate that a new Bull market will begin three to six months before a potential recession ends.

From 2017 to early 2022 we held less cash than normal, and that was the right call until the beginning of 2022 as the economy was strong and interest rates were unusually low. Today we are in a different environment as Treasury Bills yield more than 4% amidst a slowing economy. This has changed the opportunity cost of being fully invested in stocks. We have a higher than normal percentage of accounts invested in an exchange traded fund that holds Treasury Bills. We expect elevated volatility in 2023 as the market attempts to figure out the direction of interest rates and the economy. We have a list of stocks that we would like to buy at lower prices. We plan on opportunistically redeploying our Treasury Bill holdings into stocks during the year.

Bonds have not had a meaningful yield since the Great Financial Crisis. As the Fed has raised rates, bonds are once again a viable option for some investors. We have recently begun allocating a portion of accounts to bonds for some clients that have told us they would like to take less risk or no longer need to be fully invested in stocks. We are able to invest in Treasury Notes and Investment Grade Corporate Bonds at yields between 4% and 5%. For those looking for tax-free income, we are able to invest in municipal bonds with yields between 3% and 4%. If you are in the top tax bracket that equates to a 5% to 6.6% corporate bond equivalent yield with slightly less risk. We also have a preferred stock strategy with a current yield of about 6%. If you are interested in learning more about the current opportunities in bonds or preferred stocks please reach out to your Brasada Financial Advisor.

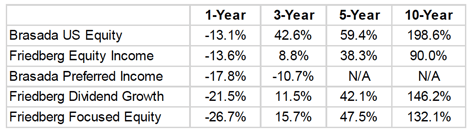

In 2022 the S&P 500 declined by 18.1%, the Nasdaq declined by 32.5%, and the Barclays Aggregate Bond Index declined by 14.9%. Estimated returns for our composites net of fees are listed below:We tend to own our stocks for a long time and 2022 was a tough year for many of our long-time holdings in our Focused Equity and Dividend Growth strategies. For example, we first started buying ANSYS in 2001. In 2022 the stock was down 40%, which was the worst year for the stock since we’ve owned it. We have owned American Tower since 2010. It was down 27% in 2022 which was the worst year for the stock since 2008. We have owned Zoetis since 2016. It went public in 2013. It was down 40% in 2022, which was the first down year ever for the stock. We began purchasing Rexford Industrial Realty in 2016. It was down 32% in 2022 which was also the first down year ever for the stock. Nothing has changed with the fundamentals of these companies. Their performance in 2022 is primarily a result of them being revalued down as interest rates reset higher. We think the long term prospects for all of these companies are bright and we intend to hold them for the foreseeable future. We continue to think that owning well managed companies that are differentiated with long term growth drivers is the best way to make money overtime.

We are invested in the same strategies as you. We hate losing money and are glad to close the door on 2022. We don’t know what will happen with the markets in the next three months, but we are near the end of the rate hikes, we think the Fed is close to conquering inflation, and a new business cycle will begin again. We are optimistic on the long-term prospects for the companies that we own. We appreciate the confidence you have placed in us and wish you the best in the new year.

Happy New Year,

Jonathan Reichek, CFA

This quarterly update is being furnished by Brasada Capital Management, LP (“Brasada”) on a confidential basis and is intended solely for the use of the person to whom it is provided. It may not be modified, reproduced or redistributed in whole or in part without the prior written consent of Brasada. This document does not constitute an offer, solicitation or recommendation to sell or an offer to buy any securities, investment products or investment advisory services or to participate in any trading strategy.

The net performance results are stated net of all management fees and expenses and are estimated and unaudited. These returns reflect the reinvestment of any dividends and interest and include returns on any uninvested cash. In addition to management fees, the managed accounts will also bear its share of expenses and fees charged by underlying investments. The fees deducted herein represent the highest fee incurred by any managed account during the relevant period. Past performance is no guarantee of future results. Certain market and economic events having a positive impact on performance may not repeat themselves. The actual performance results experienced by an investor may vary significantly from the results shown or contemplated for a number of reasons, including, without limitation, changes in economic and market conditions.

References to indices or benchmarks are for informational and general comparative purposes only. There are significant differences between such indices and the investment program of the managed accounts. The managed accounts do not necessarily invest in all or any significant portion of the securities, industries or strategies represented by such indices and performance calculation may not be entirely comparable. Indices are unmanaged and have no fees or expenses. An investment cannot be made directly in an index and such index may reinvest dividends and income. References to indices do not suggest that the managed accounts will, or is likely to achieve returns, volatility or other results similar to such indices. Accordingly, comparing results shown to those of an index or

benchmark are subject to inherent limitations and may be of limited use.

Certain information contained herein constitutes forward looking statements and projections that are based on the current beliefs and assumptions of Brasada and on information currently available that Brasada believes to be reasonable. However, such statements necessarily involve risks, uncertainties and assumptions, and prospective investors may not put undue reliance on any of these statements. Due to various risks and uncertainties, actual events or results or the actual performance of any entity or transaction may differ materially from those reflected or contemplated in such forward-looking statements. The information contained herein is believed to be reliable but no representation, warranty or undertaking, expressed or implied, is given to the accuracy or completeness of such information by Brasada.

“Far more money has been lost by investors preparing for corrections or trying to anticipate corrections than has been lost in corrections...

.png)

UNDERSTANDING TARIFFS: ECONOMIC IMPACT, RATIONALE AND CONTROVERSIES

%20(3).png)

Market Selloff Dear Clients and Friends, Thursday and Friday marked the 4th time in the last 50 years when the S&P 500 had a 2-day drop of over...