Second Quarter of 2025

“Far more money has been lost by investors preparing for corrections or trying to anticipate corrections than has been lost in corrections...

6 min read

Mark McMeans, CFA

:

Jan 8, 2024 8:00:00 AM

Mark McMeans, CFA

:

Jan 8, 2024 8:00:00 AM

I want to welcome the clients of GCI Investors, which recently merged into Brasada. GCI was started as a Registered Investment Advisor twenty-seven years ago with a remarkably similar mission to Brasada’s and that was to help clients achieve their investing goals by creating customized portfolios of well-researched stocks having long-term time horizons. We worked on this merger for about ten months and were surprised that we had not previously known each other. Both firms have had a similar approach, investment philosophy, and the same hometown. The GCI team has successfully managed an equity portfolio over its history and their performance has been almost identical to our Friedberg Focused Equity strategy. Both teams will now be stronger, and we will be able to deploy more resources to our combined clients. For the press release and the welcome video that was recently posted, see: https://brasadacapital.com/welcome

Secondly, please make note that Brasada’s Annual Client and Friends Dinner will be on Thursday, February 22nd, 2024, at the Briar Club in Houston. We will have time for the usual fellowship and our outlook for the markets. This year’s keynote speech will be on the very timely topic of artificial intelligence, and how it might be changing the future. Dr. Peter Stone, founder, and director of the Learning Agents Research Group within the Artificial Intelligence Laboratory at the University of Texas at Austin will deliver this talk. Dr. Stone is also Executive Director of the AI America’s division of the Sony Corporation. Invitations will be forthcoming. Please watch for your RSVP information or call one of us for more details. For a message on the event, please see: https://youtu.be/AbXfBSHcwJk

Now, on to the markets. The fourth quarter witnessed strong returns for both equities and bonds on the prospect that the Federal Reserve has pulled off the equivalent of ice skating’s most challenging move: the quadruple axel. This jump involves four and a half rotations in the air, making it the most difficult and rarest jump in figure skating. Two years ago, the Fed faced a daunting task. Inflation had broken out to forty-year highs, Federal government spending continued at a reckless pace, and the global economy was suffering from distortions caused by pandemic shutdowns.

The Fed’s response to much higher inflation has been a swift and historic tightening of monetary conditions. Fed funds rates were hiked eleven times in the seventeen months from March ’22 through July of this year, changes in liquidity were brought to a standstill and the Fed began to sell bonds from its portfolio that had been accumulated over the previous fifteen years. The magnitude of this reaction has been a major overhang on the markets. This is the twelfth tightening cycle since the 1960’s, and in only one of those instances, 1994, was there clearly a “soft landing”, where the economy was not slowed to the point where a recession ensued in order to quell inflation.

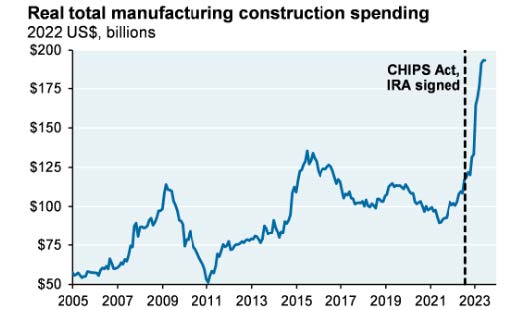

Normally a spike up in interest rates would be expected to slow the economy down, but this time has been unique and that hasn’t been the case. Surprisingly, corporate interest expense as a function of total revenues has declined in the last two years. The reason for this is that companies have long since termed out their debt levels, and many smartly locked in low rates for years to come. In the meantime, the economy continued to grow, and they were able to earn much higher yields on cash balances. It is a similar story for residential housing as 30-year mortgage rates approached 8% earlier this year, however the average mortgage rate held by US homeowners is now a much lower 3.5%. The impact of much higher rates has been diminished so far by the lowest housing inventory in decades. Otherwise, there could have been far greater negative impacts on home prices, permits and starts. Also, the Federal government continues on a spending binge with programs enacted like the Inflation Reduction Act and the CHIPS Act. To be fair, these government deficits are unsustainable with now much higher levels of interest expense on the horizon, but for now it has helped to reduce the impact of higher rates.

Source: Bloomberg, JP Morgan

Source: Bloomberg, JP Morgan

The Fed has signaled that they are done hiking rates for now and part of the reaction in the markets this quarter is the certainty that provides. The market is now pricing in rate cuts during 2024 as headline inflation has fallen from a cycle high of over 9% in the Summer of 2022, to just over 3% in the latest twelve-month reading. Recent economic indicators point to a cooling economy, but one that is still growing. The job market continues to be strong with twenty-four consecutive months of unemployment rates less than 4%. Corporate earnings have also held up better than expected this year, and the US Dollar has been weaker of late which provides a tailwind.

This strong set up provided a relief rally and fueled the market’s exceptionally strong quarter. As the year ended, the S&P 500 finished up nine consecutive weeks for the first time in almost twenty years. In the fourth quarter, major equity indices finished up 11% - 14%, and bonds gained in value with yields moving down. The 10-year US Treasury ended the year with a yield of 3.87%, which is 0.70% lower this quarter, and is lower from its highs of the year by 1.1%. The move down in rates has also been a positive for stocks.

In hindsight, it was easy to be pessimistic about the prospects for the markets at the beginning of this year. 2022 was brutal and there were only 6 years in the last 100 with worse performance. Each of those years were during or just after a recession. Coming into the year our investment team believed the chances for a recession in 2023 were elevated for reasons we have spelled out in our previous letters. Fortunately, we did not allow that pessimism to get the best of us and we brought down cash levels from a more defensive posture and continued to focus on finding great companies for your portfolios. 2023 reinforced a great lesson which is to not get caught up in all the negative news, to doggedly stick with our investing process, and to make sure we have your strategy objectives in alignment with what works best for you.

One of 2023’s oddities is that the S&P 500 has been heavily concentrated in its top stocks. This has occurred because the index’s composition is weighted by each stock’s market capitalization. This year, just under one-third of the S&P 500’s weighting is comprised of only ten stocks, and those companies only represent 21% of the index’s earnings. High levels of concentration in top names has historically been an unhealthy market signal. The last time the S&P 500 was this concentrated was 1973, with an honorable mention going to 1999. These top ten companies drove 75% of the index’s returns in 2023, which is just below twice the average return contribution of the last ten years. There are probably a few reasons why this has occurred, with the top one being that these stocks have been viewed as a haven during a period of very high pessimism. While it was difficult to outperform the major indices this year, we are seeing many more investment opportunities outside the handful of top stocks that drove the market in 2023.

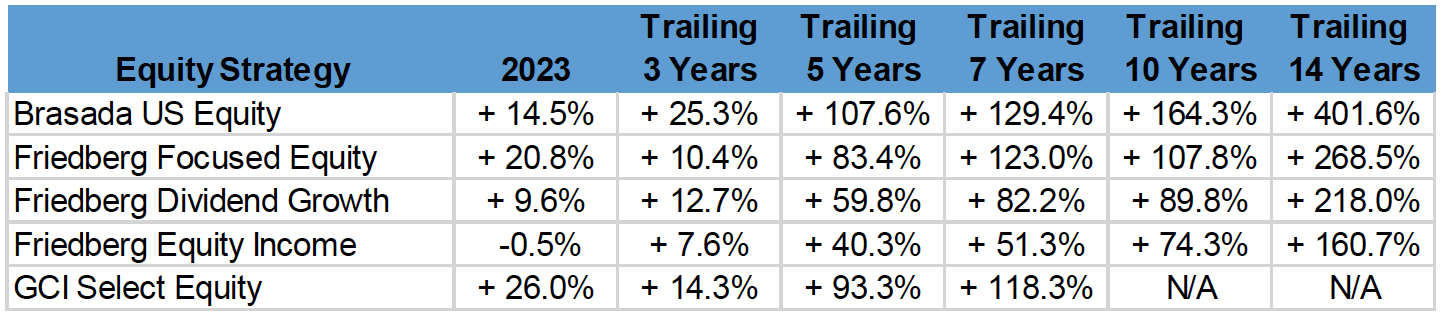

Our estimated equity strategy returns, net of fees, are shown below. The GCI Select Equity strategy is now shown, and as we have done at Brasada, their returns are shown in accordance with the Global Investment Performance Standards.

We have increased allocation to bonds for many of you during 2023, and this was the first time in the last fifteen years that we have been able to think more about utilizing bonds in a meaningful way. We are now investing in highly rated corporate bonds with yields in the 4’s and highly rated municipal bonds with yields in the 3’s.

We appreciate the confidence you have placed in us and wish you the best in 2024.

Sincerely,

Mark E. McMeans, CFA

This quarterly update is being furnished by Brasada Capital Management, LP (“Brasada”) on a confidential basis and is intended solely for the use of the person to whom it is provided. It may not be modified, reproduced or redistributed in whole or in part without the prior written consent of Brasada. This document does not constitute an offer, solicitation or recommendation to sell or an offer to buy any securities, investment products or investment advisory services or to participate in any trading strategy.

The net performance results are stated net of all management fees and expenses and are estimated and unaudited. These returns reflect the reinvestment of any dividends and interest and include returns on any uninvested cash. In addition to management fees, the managed accounts will also bear its share of expenses and fees charged by underlying investments. The fees deducted herein represent the highest fee incurred by any managed account during the relevant period. Past performance is no guarantee of future results. Certain market and economic events having a positive impact on performance may not repeat themselves. The actual performance results experienced by an investor may vary significantly from the results shown or contemplated for a number of reasons, including, without limitation, changes in economic and market conditions.

References to indices or benchmarks are for informational and general comparative purposes only. There are significant differences between such indices and the investment program of the managed accounts. The managed accounts do not necessarily invest in all or any significant portion of the securities, industries or strategies represented by such indices and performance calculation may not be entirely comparable. Indices are unmanaged and have no fees or expenses. An investment cannot be made directly in an index and such index may reinvest dividends and income. References to indices do not suggest that the managed accounts will, or is likely to achieve returns, volatility or other results similar to such indices. Accordingly, comparing results shown to those of an index or

benchmark are subject to inherent limitations and may be of limited use.

Certain information contained herein constitutes forward looking statements and projections that are based on the current beliefs and assumptions of Brasada and on information currently available that Brasada believes to be reasonable. However, such statements necessarily involve risks, uncertainties and assumptions, and prospective investors may not put undue reliance on any of these statements. Due to various risks and uncertainties, actual events or results or the actual performance of any entity or transaction may differ materially from those reflected or contemplated in such forward-looking statements. The information contained herein is believed to be reliable but no representation, warranty or undertaking, expressed or implied, is given to the accuracy or completeness of such information by Brasada.

“Far more money has been lost by investors preparing for corrections or trying to anticipate corrections than has been lost in corrections...

.png)

UNDERSTANDING TARIFFS: ECONOMIC IMPACT, RATIONALE AND CONTROVERSIES

%20(3).png)

Market Selloff Dear Clients and Friends, Thursday and Friday marked the 4th time in the last 50 years when the S&P 500 had a 2-day drop of over...