Second Quarter of 2025

“Far more money has been lost by investors preparing for corrections or trying to anticipate corrections than has been lost in corrections...

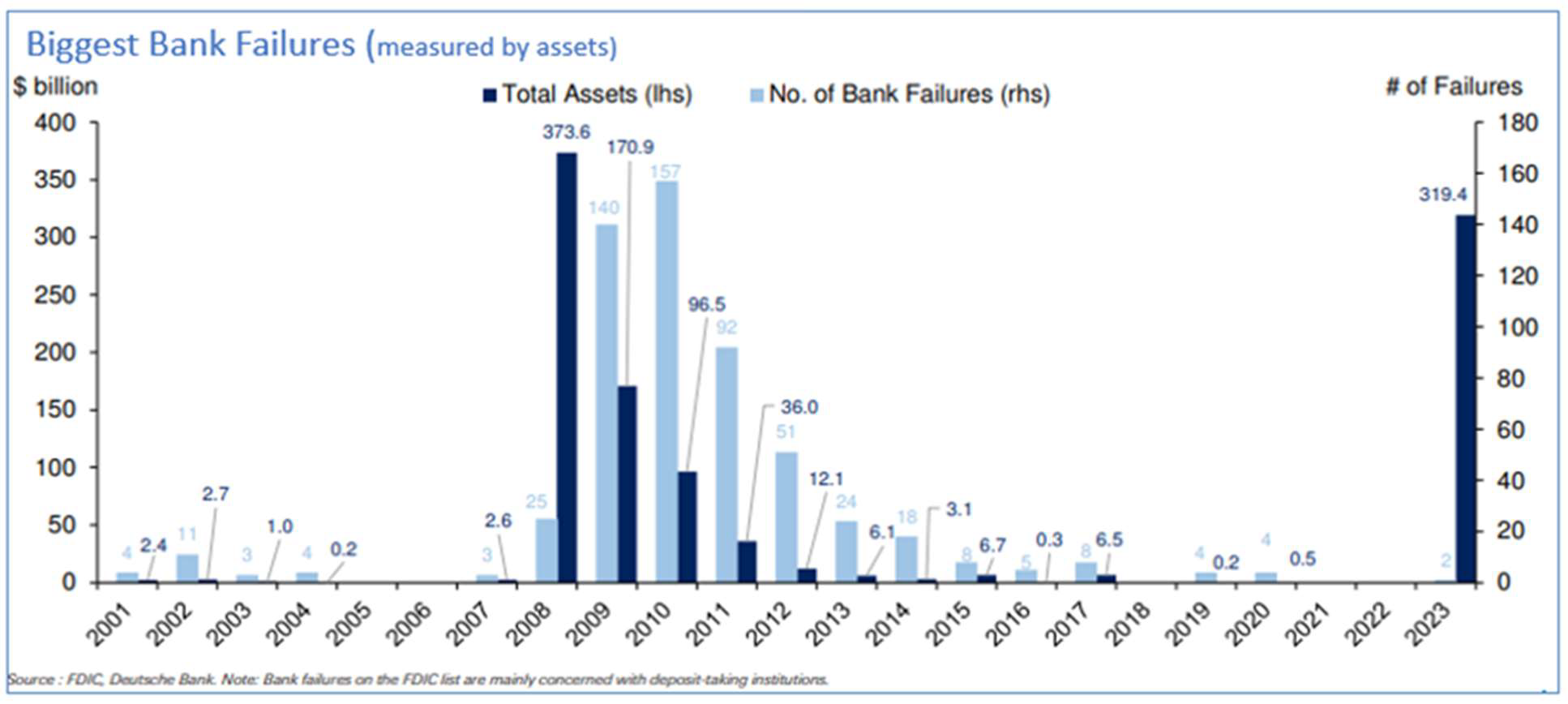

The first quarter of 2023 was looking like a small reprieve from 2022. Silicon Valley Bank then had a 1930’sstyle bank run and failed to issue equity to save itself. With around $200 billion in assets, its demise is one of the largest bank failures since 2008. While that sounds dramatic, its failure was a result of poor management, and a customer base of tech companies and venture capitalists who all talked to each other and essentially coordinated a run on the bank. Unlike most banks, an extraordinary number of accounts, 88%, were above the FDIC limit. Subsequently, the bank has been sold off to a competitor with the government facilitating the transaction, and all depositors will be made whole. Silvergate Bank and Signature Bank of New York also failed, and Credit Suisse was forced to sell itself to UBS.

The pressures on banks today are very different from 2008. When most of us consider a financial crisis, we think of poorly written loans defaulting as they did in 2008. The recent bank failures were a function of the cost of deposits increasing rapidly relative to the yield on banks’ investment portfolios. Policymakers and regulators guaranteed the system had plenty of capital to absorb large losses or shocks. In retrospect, it was this, along with aggressive monetary policy, that laid down roots for the current banking turmoil.

In recent weeks, the banking sector has shown some resilience and customer deposit flight to higher yielding cash-equivalent instruments has not been overwhelming for the system. However, banks are still challenged as they must pay more to depositors while lending at low rates. We expect this will result in a slowdown in lending to consumers and small businesses.

The larger implication from the banking crisis is that after over a year of rapid interest rate increases, the Fed has finally broken something and will be limited in raising interest rates from here for the time being. In fact, the market expects the Fed to cut rates before year end.

Updated Outlook

The macro environment today is incredibly confusing. The Fed raised rates in March and Powell said they don’t plan on cutting rates this year, yet the market expects the Fed will cut rates multiple times from here by year end. The yield curve is deeply inverted, which is a signal that a recession is coming. There are market strategists that claim we are in a new Bull market, while many others believe that the Bear market is not over and we will hit new lows. The market has been resilient and has overcome several obstacles since the end of 2021 including:

If we spent 90% of our time trying to determine the direction of the economy or market, we would be unsuccessful. We instead spend 90% of our time following the companies we own and searching for new ones to purchase. We expect to remain in a volatile environment and believe that there are many obstacles in front of the markets. We are operating with an increased sense of caution. We have adjusted the holdings in the portfolios to make them more defensive. We also continue to hold an above average percentage of accounts in Short Term Treasury Bill ETFs that yield upwards of 4%. We don’t know how the market will perform in this year or in any given year, but we are confident that over the long term being invested in a portfolio of unique companies, with first class management teams that are recession resistant, and have long term tailwinds will lead to superior returns.

For the first quarter the S&P 500 was up 7.5% and the Dow Jones Industrial Average was up 0.9%. Dividend and value stocks struggled in the quarter while, growth names did well and bounced back nicely from 2022. Our private account strategies’ estimated performance in the first quarter is as follows:

As you know, the portfolios we build for you are customized, so your experience will typically be different than the composite averages. As a reminder we are invested alongside the client in the same strategies. Unlike many Financial Advisors we believe it’s critical that we invest our money the same way we invest your money. We appreciate the confidence you have placed in us and wish you the best.

Sincerely,

Jonathan Reichek, CFA

This quarterly update is being furnished by Brasada Capital Management, LP (“Brasada”) on a confidential basis and is intended solely for the use of the person to whom it is provided. It may not be modified, reproduced or redistributed in whole or in part without the prior written consent of Brasada. This document does not constitute an offer, solicitation or recommendation to sell or an offer to buy any securities, investment products or investment advisory services or to participate in any trading strategy.

The net performance results are stated net of all management fees and expenses and are estimated and unaudited. These returns reflect the reinvestment of any dividends and interest and include returns on any uninvested cash. In addition to management fees, the managed accounts will also bear its share of expenses and fees charged by underlying investments. The fees deducted herein represent the highest fee incurred by any managed account during the relevant period. Past performance is no guarantee of future results. Certain market and economic events having a positive impact on performance may not repeat themselves. The actual performance results experienced by an investor may vary significantly from the results shown or contemplated for a number of reasons, including, without limitation, changes in economic and market conditions.

References to indices or benchmarks are for informational and general comparative purposes only. There are significant differences between such indices and the investment program of the managed accounts. The managed accounts do not necessarily invest in all or any significant portion of the securities, industries or strategies represented by such indices and performance calculation may not be entirely comparable. Indices are unmanaged and have no fees or expenses. An investment cannot be made directly in an index and such index may reinvest dividends and income. References to indices do not suggest that the managed accounts will, or is likely to achieve returns, volatility or other results similar to such indices. Accordingly, comparing results shown to those of an index or

benchmark are subject to inherent limitations and may be of limited use.

Certain information contained herein constitutes forward looking statements and projections that are based on the current beliefs and assumptions of Brasada and on information currently available that Brasada believes to be reasonable. However, such statements necessarily involve risks, uncertainties and assumptions, and prospective investors may not put undue reliance on any of these statements. Due to various risks and uncertainties, actual events or results or the actual performance of any entity or transaction may differ materially from those reflected or contemplated in such forward-looking statements. The information contained herein is believed to be reliable but no representation, warranty or undertaking, expressed or implied, is given to the accuracy or completeness of such information by Brasada.

“Far more money has been lost by investors preparing for corrections or trying to anticipate corrections than has been lost in corrections...

.png)

UNDERSTANDING TARIFFS: ECONOMIC IMPACT, RATIONALE AND CONTROVERSIES

%20(3).png)

Market Selloff Dear Clients and Friends, Thursday and Friday marked the 4th time in the last 50 years when the S&P 500 had a 2-day drop of over...